Kave Tax & Business Consultants, LLC. It gives them a chance to focus on the everyday operations of their business. We have the appropriate experience, you could set yourself up as a freelancer; however, by starting with a tax preparation franchise, you will receive courses, seminars, and training.As a business Consultant, I get a great deal of satisfaction in working with others to better their businesses, and seeing the fruits of my labor when I drive down the street and find that business still thriving some years after my recommendations and implementations.

SMALL BUSINESS SOLUTIONS BUSINESS CONSULTING.

We focus on 13 key areas of start-up business management that enables them to plan, understand and grow their business.

Modernize Operations.

Financial Management,

Business Support,

Market Planning.

Process Improvement.

Redefine Workforce.

Talent Management,

Organizational & remodeling.

Energize Strategy.

Business planning & Growth,

Innovation,

Customer Loyalty & Engagement,

Etic.

We Incorporate the following entities with our strategies:

• C Corporation

•S Corporation

•Limited Liability Company (LLC)

•Limited Partnership (LP)

•Limited Liability Partnership (LLP)

•Non-Profit Corporation

Kave Tax & Business Consultants, LLC. It gives them a chance to focus on the everyday operations of their business. We have the appropriate experience, you could set yourself up as a freelancer; however, by starting with a tax preparation franchise, you will receive courses, seminars, and training.As a business Consultant, I get a great deal of satisfaction in working with others to better their businesses, and seeing the fruits of my labor when I drive down the street and find that business still thriving some years after my recommendations and implementations.

Choosing a Business Legal Structure

Like all entrepreneurs, business consultants are faced with the decision of how to legally structure their business operation. You may be familiar with the different forms of legal structures, Sole Proprietorship, Partnership, Corporation or Limited Liability Company, but it’s worthwhile to review them briefly so that you can consider your options. In this section we will look at the advantages and disadvantages of each for businesses.

SMALL BUSINESS SOLUTIONS BUSINESS CONSULTING.

We focus on 13 key areas of start-up business management that enables them to plan, understand and grow their business.

Modernize Operations.

Financial Management,

Business Support,

Market Planning.

Process Improvement.

Redefine Workforce.

Talent Management,

Organizational & remodeling.

Energize Strategy.

Business planning & Growth,

Innovation,

Customer Loyalty & Engagement,

Etic.

We Incorporate the following entities with our strategies:

• C Corporation

•S Corporation

•Limited Liability Company (LLC)

•Limited Partnership (LP)

•Limited Liability Partnership (LLP)

•Non-Profit Corporation

10 STEPS TO STARTING YOUR OWN BUSINESS Are you ready to became an entrepreneur?

Starting your own business is also an emotionally appealing choice. You might envision:

• Working from home and having more time to spend with your family.

Having the freedom to work only on projects that are socially responsible and challenge you intellectually.

Being able to work the hours you want so you have time for the pursuits you enjoy.

Having the financial means to achieve your other life goals. You may rightly feel that predictions about the number of new business failures don’t apply to you because you are not starting from the same place as other entrepreneurs Because of your business expertise, you may have greater confidence, connections, and access to the resources you will need to get started.

1-Personal Assessment

2-Hone your idea

3-Develop your Business Plan

4-Determine your legal structure.

5-Set up your bookkeeping

6-Get permits, Licensing and Insurance

7-Selecting your Location

8-Build your internet presence

9-Put together your Team

10-Get financing

You may contact us for registration of sole proprietorship business and expert advice for tax matters.

Sole Proprietorship

Advantages

Low start-up costs

Greatest freedom from regulation

Owner all profits Use

Owner Abilities.

Owner in direct control of decision.

The business can be terminated with minimum of fuss.

Ease of dissolving.

Disadvantages

Unlimited liability

Limited skills to manage and expand the business

Difficult to raise capital.

Long hours and difficult to take days off.

Business cease when the owner dies.

You may contact us for registration of sole proprietorship business and expert advice for tax matters.

Sole proprietorship

A sole proprietorship is an unincorporated business owned by a single individual. Freelancers and many other self-employed people are, in legal terms, operating a sole proprietor business.

A sole proprietorship is the simplest and most common type of business structure. It is owned and operated by one individual, and there is no legal distinction between the owner and the business.

Key Features of a Sole Proprietorship:

Single Owner: One person owns and runs the business.

Easy to Start: Minimal legal paperwork and lower start-up costs.

Full Control: The owner makes all business decisions.

Tax Simplicity: Business income is reported on the owner’s personal income tax return.

Unlimited Liability: The owner is personally responsible for all business debts and legal actions. This means personal assets (like a house or car) can be used to settle business liabilities.

Examples:

A freelance graphic designer

A local bakery run by one person

A handyman offering services under their own name

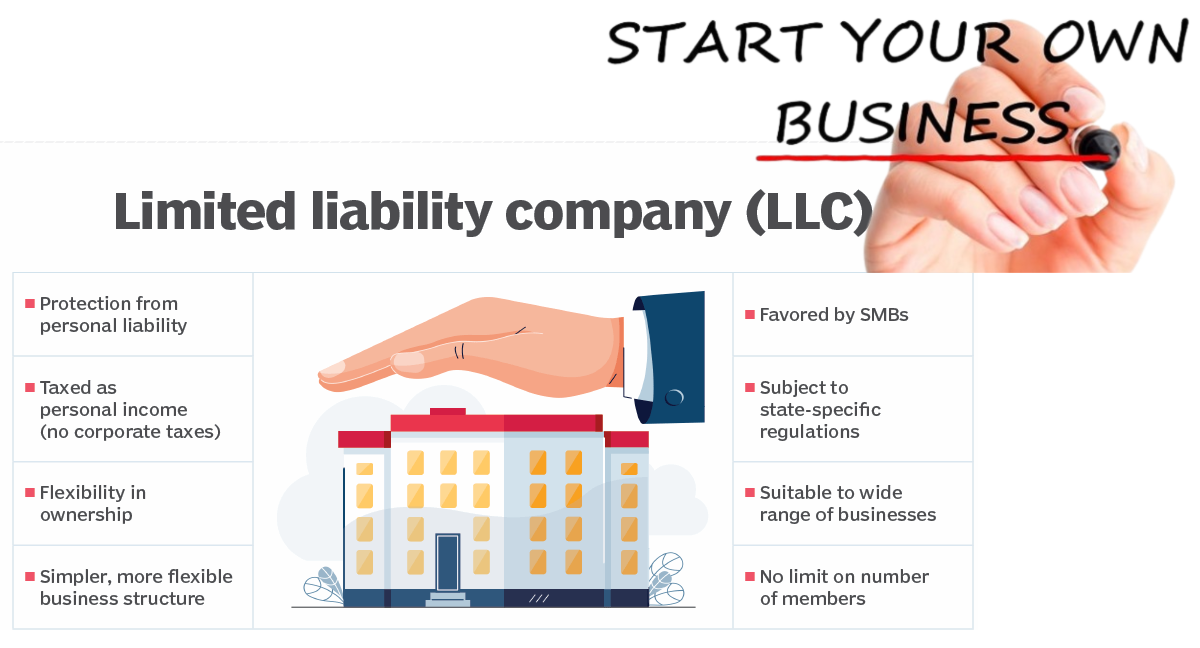

Limited Liability Company (LLC)

LLCs are generally the preferred entity structure for certain professionals and landlord as it is a corporate structure where the members (owners) cannot be held personally liable for the company’s liabilities. LLCs have flexibility as the owners can file as a partnership, S Corporation or even sole proprietor since the LLC is really a legal and not tax designation.

An LLC business structure gives you the benefits of a partnership or S corporation while providing personal asset protection like a corporation. Similar to incorporating, there will be substantial paperwork involved in establishing this business structure. LLCs have flexible tax options, but are usually taxed like a partnership.

Here are some of the advantages and disadvantages of LLCs:

Advantages

Limited liability similar to a corporation

Tax advantages similar to a corporation

Can be started with one (except in Massachusetts) or more members like a sole proprietorship or partnership

Disadvantages

More costly to start than a sole proprietorship or partnership

Consensus among members may become an issue

LLC dissolves if any member leaves.

You may contact us for registration of a Partnership business and expert advice for tax matters.

A Limited Liability Company is formed by filing articles of organization with the individual state’s Secretary of State. Owners of an LLC are called members. Members may include individuals, corporations, other LLCs, and foreign entities. An LLC can be formed by one or more members, and there is no maximum number of members.

LLCs are generally the preferred entity structure for certain professionals and landlord as it is a corporate structure where the members (owners) cannot be held personally liable for the company’s liabilities.

LLCs have flexibility as the owners can file as a partnership, S Corporation or even sole proprietor since the LLC is really a legal and not tax designation.

An LLC (Limited Liability Company) is a business structure that combines elements of both a corporation and a sole proprietorship or partnership. It’s popular because it offers limited liability protection for its owners while being relatively simple to manage.

Key Benefits:

Limited Liability: Protects the personal assets of the members (owners).

Pass-Through Taxation: Business profits/losses go directly to the owners’ personal tax returns—no corporate tax (unless elected).

Flexible Ownership: Can have one owner (single-member LLC) or many (multi-member LLC).

Fewer Formalities: Less regulation than a corporation (no board meetings, fewer paperwork requirements).

Credibility: Having “LLC” in your business name can make your business appear more professional and established.

🆚 LLC vs Sole Proprietorship

| Feature | Sole Proprietorship | LLC |

|---|---|---|

| Liability Protection | ❌ No | ✅ Yes |

| Setup Complexity | ✅ Very Easy | ⚠️ Moderate |

| Tax Filing | ✅ Simple (on personal tax) | ✅ Pass-through (or choose corporate) |

| Legal Separation | ❌ None | ✅ Separate legal entity |

| Ownership | 👤 One owner only | 👥 One or more members |

A partnership is a business that two or more individuals own and operate together. Unlike other business structures, there are multiple types of partnership you can establish.

The relationship between the partners, type of ownership, and duties of each partner are typically outlined in a partnership agreement. Depending on the amount of participation in the partnership, partners may be liable for business debts.

If you’re familiar with partnerships, you’ve likely heard of general and limited partnerships. However, there are a couple of other forms of partnership out there. Check out the four types of partnership below:

Limited partnership

General partnership

Limited liability partnership

LLC partnership

A Partnership is a formal agreement between two or more people to become the company’s co-owners. The partners involved in the company have the right to invest and share profits and also losses.

Here are the key advantages of a partnership:

1. Ease of Formation

Simple and inexpensive to establish.

Fewer legal formalities compared to corporations.

Can often be started with just a partnership agreement.

🔹 2. Shared Resources and Skills

Combines the skills, expertise, and experience of multiple partners.

Access to more capital, tools, and contacts than a sole proprietorship.

🔹 3. Greater Decision-Making Power

Partners can share decision-making duties.

Diverse perspectives can lead to better problem-solving and innovation.

🔹 4. Shared Financial Commitment

Partners share the financial burden of starting and running the business.

Reduces individual risk.

5. Flexibility

Less regulation and formalities than corporations.

Partnership agreements can be tailored to suit specific needs and responsibilities.

🔹 6. Pass-Through Taxation

Profits are passed through to partners and taxed only at the individual level.

Avoids double taxation (unlike corporations).

🔹 7. Stronger Motivation and Accountability

Shared ownership can encourage more commitment and accountability from each partner.

Here are the key disadvantages of a partnership business structure:

🔻 1. Disagreements Among Partners

Conflicts over business decisions, profit sharing, or responsibilities can arise.

Personal differences can strain the business relationship.

🔻 2. Disagreements Among Partners

Conflicts over business decisions, profit sharing, or responsibilities can arise.

Personal differences can strain the business relationship.

🔻 3. Shared Profits

Profits must be divided among partners, even if one partner contributes more time or effort.

Disagreements about what is “fair” can create tension.

🔻 4. Limited Life of the Partnership

The partnership may dissolve if a partner dies, withdraws, or becomes bankrupt, unless otherwise stated in the partnership agreement.

🔻 5. Difficulty in Transferring Ownership

Selling or transferring a partner’s share often requires the agreement of all partners.

This makes exit or succession planning more complex.

🔻 6. Lack of Legal Distinction

The business and its partners are legally considered the same entity in a general partnership.

This limits the ability to raise funds from outside investors who often prefer limited liability structures.

🔻 7. Potential for Unequal Workload

One partner may end up doing more work while others contribute less, especially if responsibilities aren’t clearly defined.

Incorporation

incorporation of a business means that a separate, legal corporate entity has been created for the purpose of conducting business. Like an individual, corporations can be taxed, sued, can enter contractual agreements and are liable for their debts. Corporations are characterized by shareholders, a board of directors and various company officers. As such, ownership interests can be freely transferred.

Creating a corporation requires filing of numerous documents to legalize your business, as well as formally naming a president, shareholders, and director(s), all of whom can be a single person as set out in the company charter. As the rules and forms required for incorporation vary from state to state and province to province, it’s best to consult your local business licensing office or a local lawyer specializing in incorporation.

Incorporation and the issuing of stock shares allow companies to sell some of those shares to raise capital for business operations and expansion, they can also to use them as collateral for loans, or equity for venture capital investments.

When a business incorporates it creates shares which are sometimes called stock. These stock shares represent ownership of the company.

Here is a list of some of the advantages and disadvantages to incorporating your Business

Advantages

The primary advantage of corporations is that they can issue stock shares. This gives corporations the ability to attract investors and venture capitalists. Tax liability can also be limited with incorporation and income sharing.

Protect personal assets and income from liability by separating your business income and assets from your personal.

Corporations get greater tax breaks and incentives

Ownership can be sold or transferred if the owner wishes to retire or leave the business

Banks and other lending institutions tend to have more faith in incorporated businesses so raising capital is easier.

Disadvantages

Increased start-up costs

Substantial increase in paperwork

Your business losses cannot be offset against your personal income

Corporations are more closely regulated.

Traditional C corporations have two significant disadvantages. The first, worst, is double taxation on earnings. Firstly, profits from the Corporation are taxed, and then the shareholders, the business owners, and shareholders must again pay taxes when they receive dividend payments.

Because of this negative ramification, S-type corporations were developed to avoid double taxation. These type of corporations have restrictions which include a limit of 100 shareholders.

You may contact us for registration of a Partnership business and expert advice for tax matters.

S-Corporation.

An S Corporation is similar to the corporation in most ways, but with some tax advantages. The corporation can pass its earnings and profits on as dividends to the shareholder(s). However, as an employee of the corporation you do have to pay yourself a wage that meets the government’s reasonable standards of compensation just as if you were paying someone else to do your job.

Operating as an S-Corporation may be wise for several reasons:

Forming an S-corporation generally allow the shareholder to pass business losses through to their personal income tax return where they can use it to offset any income that they (and their spouse if married filing jointly) may have from other sources.

When the S-Corporation is sold, the taxable gain on the sale of the business can be less than it would have been had the shareholders operated the business as a C corporation.

Unlike active LLC owners, S-Corporation shareholders are not subject to self-employment taxes which can add up to more than 15% of your income.

Features of S-Corporation.

The entity must be a “domestic corporation”. A domestic corporation refers to an entity that cannot have non-resident shareholders as its owners.

An entity must be having its shareholders to be less than or equal to 100.

All shareholders must be individuals. However, there are certain aspects to this requirement that need to be discussed further.

Trusts and estates that are considered as charity organizations and which get exemptions from taxation and can be considered as a shareholder.

Partnerships or other corporations are not eligible to be shareholders. Family members are treated as a single shareholder in S corp. This implies that spouses or individual descendants of the elected shareholder will be considered as a single shareholder.

An entity that owns one class of stock (This simply means profits and losses are distributed to owners/ shareholders in proportion to their interest in the business).

The entity must comply with all such requirements as listed above. In the event it fails to do so, the entity will no more be granted the S corp status.

You may contact us for registration of a Partnership business and expert advice for tax matters.

C- Corporation.

A C Corporation is a type of business entity that is formed and regulated by the state. The policies, articles, and regulations for forming a C Corporation differ from state to state. In this type of business entity that is most prevalent, the owners or shareholders are taxed separately from the business entity. The taxing happens both at corporate and personal levels thereby leading to a double taxation situation.

This Corporation is owned by shareholders who in turn elect the board of directors that undertake the responsibility of making business decisions and overseeing the policy of the business.

Since this Corporation is considered as an independent entity, so it does not stop existing when there is a change of ownership or shareholding.

The owners of this Corporation have limited liability so they are personally not liable for the debts incurred by the corporation.

The owners or shareholders cannot be taken to court individually for any wrongdoing by the corporation.

Additionally, a legal requirement may force a business to become a C corporation.

Here are when a company is required to be a C-corp:

Over 100 shareholders

Foreign shareholder

Partnership or another corporation as a shareholder

Multiple classes of stock Certain institutions (insurance and financial companies)

Benefits of a C-corp

Keep profits in business without being taxed

The business entity will exist without original owners

Investor friendly

Unlimited shareholders

Limited liability: Generally, corporate shareholders are not personally liable for the debts, liabilities, and obligations of the C corporation.

No limit on shareholders: Unlike S-corps, C corporations are not limited to 100 shareholders. C-corps are an excellent option for businesses that intend to go public or have a large number of shareholders.

Disadvantages of a C-corp

Double taxation (at the corporate and individual level)

Yearly board of directors meeting

Possibly more expensive with assistance from CPA

Double taxation: C corporations are taxed first on their profits at the corporate level and then as dividends on shareholders’ individual tax returns.

Expensive to set up: In addition to state-specific filing fees between $50 and $500, filing for C corporations is a complex process that may require you to hire an attorney.

Heavily regulated: C corporations must follow strict meeting, record-keeping, and other operational requirements.

You may contact us for registration of a Partnership business and expert advice for tax matters.

Life Insurance

life Insurance is a financial product that provides a sum of money to a beneficiary upon the death of the insured person. It is primarily used to offer financial protection to loved ones or dependents after the policyholder’s death.

One decision you need to make when looking at life insurance to protect you and your family is choosing between permanent versus term life insurance. Each person’s situation is different. I will cover important aspects of each type of coverage to enable you to make the decision that is best for your situation.

You should strongly consider converting your term life insurance into permanent coverage, especially if your insurance provider has extended you a conversion provision. If you do in fact have a need for life insurance at this point in your life, your need is permanent, not temporary

There are many factors that may come into play when you choose a life insurance policy. After price, the company selling the policy could be the most important. Going with a trusted insurance company may play just as a big a part in your decision making as finding the right price point.

Most people are shocked at the cost of life insurance when they are in their 50’s or 60’s! Rarely do young people inquire about life insurance premiums for 60 year old’s. If they did, it may change their outlook on whether it’s smart to pay a little more to start a permanent life insurance policy that will last their entire life. If a permanent policy is structured correctly, premiums may only need to be paid until the age of 60. Then you essentially have free coverage for the rest of your life! In many cases, the life insurance policy can also pay you back once you get to retirement age! Then you have paid up life insurance AND another source of Tax-Free income during the retirement years.

Protection you need. Benefits you didn’t expect.

Starting out? Growing family? Nearing retirement? Life insurance from Primerica Life offers protection plus benefits that can help can fund your retirement, pay for college, or just give you financial peace of mind.*

Professional liability insurance, also known as errors and omissions insurance, will pay out to cover the cost of a mistake that harms or negatively affects a client during a professiona

✅ Main Purposes of Life Insurance

Family Financial Security – Provides income replacement for dependents.

Debt Coverage – Pays off debts like mortgages, loans, or credit cards.

Funeral Expenses – Covers burial and funeral costs.

Estate Planning – Helps in wealth transfer and managing estate taxes.

Business Continuity – Supports buy-sell agreements or covers key person losses in business.

🔹 Types of Life Insurance

| Type | Description |

|---|---|

| Term Life Insurance | Coverage for a specific period (e.g., 10, 20 years); no payout if you outlive the term. Affordable. |

| Whole Life Insurance | Permanent coverage with a savings (cash value) component; more expensive. |

| Universal Life | Flexible premium and coverage; includes a cash value component. |

| Variable Life | Includes investment options; death benefit and cash value can fluctuate. |

| Group Life | Offered by employers; often limited and may end when employment ends. |

✅ Advantages of Life Insurance

Financial security for family and dependents.

Peace of mind knowing loved ones are protected.

May accumulate cash value (in permanent policies).

Tax benefits (death benefits are often tax-free).

❌ Disadvantages

Can be expensive, especially for older individuals or permanent policies.

Complex terms and conditions.

May not offer returns comparable to other investments (for investment-linked policies).

A Self-Employment Retirement Plan (also called a self-employed retirement plan or small business retirement plan) is designed to help self-employed individuals—like freelancers, sole proprietors, and small business owners—save for retirement while also benefiting from tax advantages.

✅ Popular Self-Employment Retirement Plans

1. SEP IRA (Simplified Employee Pension)

Best for: Self-employed with no or few employees.

Contributions: Up to 25% of net earnings, maxing out at $69,000 in 2024.

Tax Benefits: Contributions are tax-deductible, and earnings grow tax-deferred.

Easy to set up with minimal paperwork.

2. Solo 401(k) (Also called Individual 401(k))

Best for: Self-employed individuals with no employees (except a spouse).

Contributions:

Employee deferral: up to $23,000 (or $30,500 if over age 50 in 2024).

Employer contribution: up to 25% of net earnings.

Total max: $69,000 (or $76,500 with catch-up contributions).

Tax Benefits: Contributions reduce taxable income; option for Roth contributions too.

3. Simple IRA

Best for: Self-employed or small business owners with up to 100 employees.

Contributions: Up to $16,000 in 2024 ($19,500 if age 50+).

Employer Match: Must match employee contributions (up to 3%) or contribute 2% of each eligible employee’s compensation.

Easier and cheaper than a 401(k).

4. Defined Benefit Plan

Best for: High-income self-employed individuals looking to save large amounts.

Works like a traditional pension plan.

Annual contributions can be well over $100,000, depending on age and income.

Requires actuarial services and more administrative work.

✅ Benefits of Self-Employed Retirement Plans

Reduce current taxable income.

Grow retirement savings with tax-deferred or tax-free (Roth) growth.

Help attract and retain employees (if applicable).

Flexible contribution amounts (in many plans).

❌ Challenges

Some plans have administrative costs and complexity.

Contribution limits may vary annually.

Rules and penalties apply for early withdrawals.